What are the alternative ways to finance a home purchase? This question often arises for aspiring homeowners who may not have access to traditional mortgage financing. Fortunately, there are numerous innovative options available to help individuals achieve their homeownership dreams.

From government-backed programs to seller financing and lease-to-own arrangements, this comprehensive guide will explore the diverse range of alternative financing options available. Whether you’re a first-time homebuyer or looking to upgrade your current home, this exploration will provide valuable insights and empower you to make informed decisions.

Alternative Financing Options

In addition to traditional mortgages, there are several alternative financing options available for home purchases. These options can provide more flexibility and accessibility to homeownership for individuals who may not qualify for traditional financing.

FHA Loans

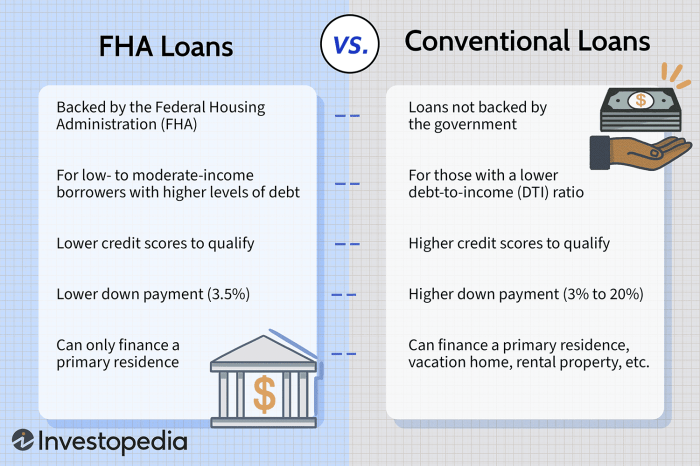

FHA loans are insured by the Federal Housing Administration (FHA) and are designed for first-time homebuyers and those with lower credit scores. They typically require a lower down payment (as low as 3.5%) and have more flexible credit requirements than conventional loans.

VA Loans

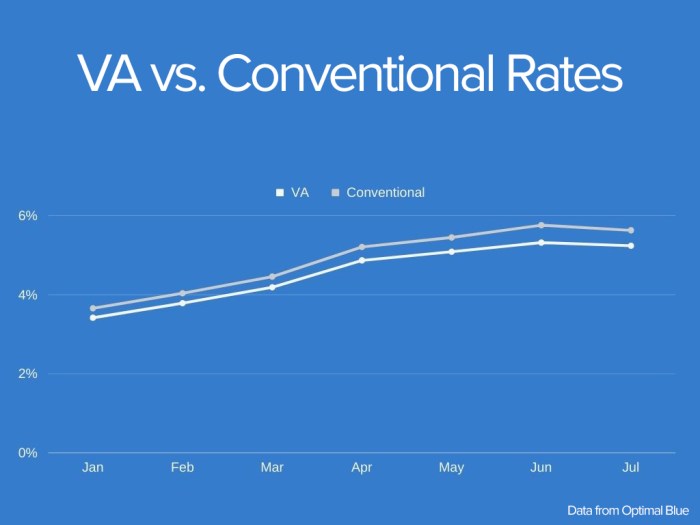

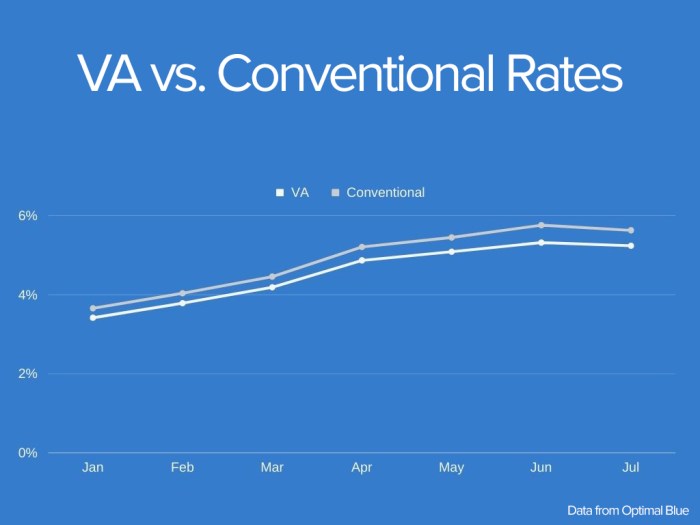

VA loans are guaranteed by the Department of Veterans Affairs (VA) and are available to eligible veterans, active-duty military members, and their surviving spouses. They offer competitive interest rates, no down payment requirements, and no private mortgage insurance (PMI).

USDA Loans

USDA loans are guaranteed by the United States Department of Agriculture (USDA) and are designed for low- to moderate-income families in rural areas. They offer low interest rates, no down payment requirements, and no PMI.

Rent-to-Own Programs

Rent-to-own programs allow buyers to rent a home with the option to purchase it at the end of the lease term. This can be a good option for individuals who need time to improve their credit or save for a down payment.

Down Payment Assistance Programs

Down payment assistance programs are a lifesaver for many homebuyers who don’t have a large down payment saved up. These programs can provide grants, loans, or other forms of financial assistance to help cover the cost of a down payment, making homeownership more accessible.

There are two main types of down payment assistance programs: government-backed programs and non-profit or community-based programs.

Government-Backed Down Payment Assistance Programs

The federal government offers a variety of down payment assistance programs through the Federal Housing Administration (FHA), the U.S. Department of Agriculture (USDA), and the Department of Veterans Affairs (VA).

Buying a home is a major financial decision, and there are several alternative ways to finance it. These include traditional mortgages, FHA loans, and VA loans. Similarly, if you’re an avid car enthusiast, you may consider financing your classic car collection with a specialized lender and insurance to ensure your prized possessions are protected.

Coming back to home financing, it’s crucial to research and compare these options to find the one that best suits your financial situation and long-term goals.

- FHA loans: FHA loans are insured by the federal government, which makes them more affordable for borrowers with lower credit scores and smaller down payments. FHA loans require a down payment of as little as 3.5%.

- USDA loans: USDA loans are available to low- and moderate-income borrowers who are purchasing homes in rural areas. USDA loans do not require a down payment.

- VA loans: VA loans are available to active-duty military members, veterans, and their spouses. VA loans do not require a down payment or private mortgage insurance.

Non-Profit and Community-Based Down Payment Assistance Programs

There are also a number of non-profit and community-based organizations that offer down payment assistance programs. These programs are typically funded by grants, donations, and other sources of funding.

To find out if you qualify for a down payment assistance program, you can contact a local housing counseling agency or visit the website of the U.S. Department of Housing and Urban Development (HUD).

Seller Financing

Seller financing is an alternative financing option in which the seller of a property provides financing to the buyer. This arrangement allows buyers to purchase a home without obtaining a traditional mortgage from a bank or lending institution.

Advantages of Seller Financing

- Flexibility: Seller financing offers more flexibility than traditional mortgages, as the terms of the loan can be negotiated directly between the buyer and seller.

- Lower closing costs: Seller financing typically involves lower closing costs compared to traditional mortgages, as there are no lender fees or mortgage insurance premiums.

- Faster closing process: The closing process for seller financing is often faster than for traditional mortgages, as there is no need for lender approval.

Disadvantages of Seller Financing

- Higher interest rates: Seller financing typically carries higher interest rates than traditional mortgages, as the seller is taking on more risk.

- Less protection for the buyer: Seller financing provides less protection for the buyer compared to traditional mortgages, as there are fewer regulations and protections in place.

- May affect the seller’s tax liability: Seller financing may affect the seller’s tax liability, as the seller may have to pay capital gains tax on the profit from the sale.

Lease-to-Own Programs: What Are The Alternative Ways To Finance A Home Purchase

Lease-to-own programs provide a unique pathway to homeownership for individuals who may not qualify for traditional mortgages or have limited down payment funds. These programs typically involve a lease agreement with an option to purchase the property at the end of the lease term.

Process and Requirements

Lease-to-own programs generally require a lease agreement for a specific period, ranging from 2 to 5 years. During the lease term, the tenant pays rent and may also make additional payments towards the purchase price. At the end of the lease, the tenant has the option to exercise the purchase option and become the homeowner.

Eligibility for lease-to-own programs often depends on factors such as income, credit history, and the property’s value. Applicants may need to provide proof of income, undergo a credit check, and meet specific down payment requirements.

Benefits

* Flexibility: Lease-to-own programs offer flexibility in terms of down payment requirements and lease terms. This can be beneficial for individuals who do not have a large down payment saved or who need more time to improve their credit scores.

* Opportunity to Build Equity: During the lease term, tenants have the opportunity to build equity in the property through their monthly payments. This can provide a financial cushion and increase their chances of securing a traditional mortgage when they exercise the purchase option.

* Potential Tax Benefits: As a homeowner, lease-to-own participants may be eligible for tax deductions on mortgage interest and property taxes.

Potential Drawbacks

* Higher Costs: Lease-to-own programs often involve higher monthly payments compared to traditional mortgages. This is because the payments include both rent and a portion of the purchase price.

* Lease Restrictions: Lease-to-own agreements may include restrictions on making modifications or improvements to the property without the landlord’s approval.

* Contingencies: The purchase option at the end of the lease term may be subject to certain contingencies, such as the tenant’s ability to secure financing or the property’s value meeting a certain threshold.

Shared Equity Mortgages

Shared equity mortgages are a financing option that allows homebuyers to purchase a home with a smaller down payment by sharing the equity in the property with a lender or other investor. This can be a good option for first-time homebuyers or those who do not have a large down payment saved up.

There are different types of shared equity mortgages, each with its own implications. One common type is the 80/20 shared equity mortgage, in which the lender provides 80% of the purchase price and the borrower provides the remaining 20%. The lender then receives a proportional share of the home’s appreciation, and the borrower receives the remaining share. Another type of shared equity mortgage is the silent second mortgage, in which the lender provides a second mortgage that is subordinate to the first mortgage. The lender then receives a share of the home’s appreciation, but the borrower is responsible for making the payments on both mortgages.

Shared equity mortgages can be a good option for homebuyers who are unable to qualify for a traditional mortgage or who do not have a large down payment saved up. However, it is important to understand the terms of the loan and the implications of sharing the equity in the property before signing on the dotted line.

Pros of Shared Equity Mortgages

* Lower down payment requirements

* Can help homebuyers qualify for a mortgage who otherwise would not

* Can help homebuyers build equity in their home more quickly

Cons of Shared Equity Mortgages

* The lender receives a share of the home’s appreciation

* The borrower may have to make payments on both a first and second mortgage

* The borrower may have less flexibility in selling or refinancing the home

Home Equity Lines of Credit (HELOCs)

A Home Equity Line of Credit (HELOC) is a loan secured by your home equity, allowing you to borrow funds up to a certain percentage of your home’s value. HELOCs can be used for various purposes, including home purchases.

When considering alternative ways to finance a home purchase, it’s crucial to choose the right loan term that aligns with your budget and affordability. By exploring choosing the right loan term based on budget and affordability , you can determine the loan duration and monthly payments that fit your financial situation.

This decision ultimately impacts your long-term financial well-being, so it’s essential to consider all options and make an informed choice that supports your homeownership goals.

When using a HELOC for a home purchase, you’ll typically draw on the credit line to make the down payment and closing costs. The interest rate on a HELOC is usually adjustable, meaning it can fluctuate over time. As a result, your monthly payments may vary.

Advantages of Using HELOCs

- Can provide access to a large sum of money for a down payment.

- May have lower interest rates than other types of loans.

- Offers flexibility in repayment terms.

Risks Associated with Using HELOCs

- The interest rate can fluctuate, potentially increasing your monthly payments.

- You may need to make monthly payments even if you’re not using the funds.

- If you default on your HELOC, you could lose your home.

Personal Loans

Personal loans offer an alternative financing option for home purchases, allowing borrowers to secure funds without using their home as collateral. These loans are typically unsecured, meaning they do not require a down payment or a specific property to be purchased.

There are various alternative ways to finance a home purchase, such as FHA loans, VA loans, and USDA loans. Additionally, competitive rates on auto loans for electric car purchases with government incentives are available, which can help you save money on your transportation costs while also reducing your carbon footprint.

These alternative financing options can make homeownership more accessible and affordable, allowing you to achieve your dream of owning a home.

Interest rates on personal loans vary depending on the lender, the borrower’s creditworthiness, and the loan amount. Loan terms generally range from two to five years, and eligibility criteria may include a minimum credit score, stable income, and a low debt-to-income ratio.

Pros of Personal Loans

- Flexibility: Personal loans can be used to finance a variety of home-related expenses, including down payments, closing costs, and renovations.

- No collateral required: Unlike mortgages, personal loans do not require a down payment or a specific property to be purchased.

- Faster approval: The approval process for personal loans is often faster than for mortgages, as they do not require a detailed underwriting process.

Cons of Personal Loans, What are the alternative ways to finance a home purchase

- Higher interest rates: Personal loans typically have higher interest rates than mortgages, which can increase the overall cost of borrowing.

- Shorter loan terms: Personal loans generally have shorter loan terms than mortgages, which can result in higher monthly payments.

- Impact on credit score: Applying for a personal loan can result in a hard credit inquiry, which can temporarily lower a borrower’s credit score.

Crowdfunding

Crowdfunding has emerged as an alternative financing option for home purchases, allowing individuals to pool funds from multiple investors or donors to finance their homeownership dreams.

There are several crowdfunding platforms that cater specifically to real estate investments. These platforms typically have a thorough screening process for both borrowers and investors, ensuring the credibility and legitimacy of the projects.

Crowdfunding Platforms

- Fundrise: Fundrise is a popular real estate crowdfunding platform that offers both debt and equity investments in residential and commercial properties.

- Roofstock: Roofstock specializes in single-family rental properties and provides investors with access to a diverse portfolio of rental properties across the United States.

- RealtyMogul: RealtyMogul offers a range of real estate investment opportunities, including debt and equity investments in both residential and commercial properties.

Rent-to-Own Options

Rent-to-own arrangements provide prospective homeowners with an alternative path to homeownership. These agreements typically involve a lease contract with an option to purchase the property at a predetermined price within a specified timeframe.

Availability and Terms

Rent-to-own options are not as widely available as traditional mortgages, but they can be found through private sellers, real estate investors, and specialized rent-to-own companies. The terms of these agreements vary significantly, including the length of the lease, the option price, and the amount of rent that goes towards the purchase price.

Advantages

* Flexibility: Rent-to-own arrangements offer more flexibility than traditional mortgages, as buyers have the option to purchase the property or walk away at the end of the lease term.

* Credit Building: Rent-to-own payments can help buyers establish or improve their credit scores, making them more eligible for traditional financing in the future.

* Opportunity to Save: A portion of the rent payments goes towards the purchase price, allowing buyers to save money for a down payment.

Potential Challenges

* Higher Costs: Rent-to-own arrangements often involve higher monthly payments than traditional mortgages due to the additional cost of the option to purchase.

* Limited Equity: Buyers may not build equity in the property until they exercise the purchase option, which can delay the financial benefits of homeownership.

* Lack of Control: Rent-to-own buyers may have limited control over the property, as the seller typically retains ownership until the purchase option is exercised.

Last Recap

In conclusion, exploring the alternative ways to finance a home purchase unveils a wealth of options that can cater to diverse financial situations. By understanding the eligibility requirements, advantages, and potential drawbacks of each financing method, individuals can strategically choose the path that aligns with their unique needs and goals.

Remember, homeownership is a significant milestone, and with the right financing solution, it can become a reality for many who may not have considered it possible. So, embrace the possibilities, research thoroughly, and take the first step towards unlocking the door to your dream home.

Quick FAQs

What is the most common alternative financing option?

Seller financing, where the seller holds the mortgage for the buyer, is a popular alternative financing method.

Can I use a personal loan to finance a home purchase?

Yes, personal loans can be used for home purchases, but they typically have higher interest rates than traditional mortgages.

What are the benefits of a shared equity mortgage?

Shared equity mortgages allow buyers to purchase a home with a lower down payment, but they also share ownership with the lender.