In the realm of eco-friendly transportation, high-value electric cars have emerged as a beacon of sustainable luxury. However, the journey towards owning one of these marvels often involves careful financial planning. This guide will equip you with the knowledge to utilize an auto loan calculator effectively, ensuring a smooth and informed decision-making process.

Delving into the intricacies of auto loans, we’ll explore how loan amounts, interest rates, and repayment terms impact your monthly payments and overall borrowing costs. Additionally, we’ll delve into the influence of credit scores, government incentives, and trade-in values on the affordability of your electric car purchase.

Loan Amount and Repayment Options

When purchasing a high-value electric car, understanding the loan amount and repayment options is crucial. The loan amount directly influences monthly payments and the total interest paid over the loan term.

Loan Amount and Monthly Payments

The loan amount is the total cost of the electric car minus any down payment made. A larger loan amount results in higher monthly payments due to the increased principal balance. Conversely, a smaller loan amount leads to lower monthly payments.

Loan Amount and Total Interest Paid

The total interest paid over the loan term is affected by the loan amount and the interest rate. A higher loan amount typically leads to more interest paid, while a lower loan amount results in less interest paid. Additionally, a longer repayment period generally means more interest paid compared to a shorter repayment period.

Down Payment

A down payment is a lump sum paid upfront towards the purchase price of the electric car. Making a down payment reduces the loan amount, which in turn lowers the monthly payments and the total interest paid over the loan term.

Interest Rates and Fees

Interest rates play a crucial role in determining the overall cost of borrowing for an auto loan. They represent the percentage of the principal amount charged by the lender for the use of the money over time. Higher interest rates result in higher monthly payments and a greater total amount paid over the life of the loan.

Typical Interest Rates for High-Value Electric Car Loans

Interest rates for high-value electric car loans can vary depending on several factors, including the lender, the borrower’s credit score, and the current market conditions. Generally, interest rates for electric car loans tend to be lower than those for traditional gasoline-powered vehicles due to the government incentives and tax credits available for electric vehicles.

As of 2023, the average interest rate for a new electric car loan ranges from 2.5% to 4.5%, while the average interest rate for a used electric car loan ranges from 3.5% to 5.5%. However, these rates can vary significantly based on individual circumstances and the lender’s policies.

Additional Fees Associated with Auto Loans

In addition to the interest rate, there may be additional fees associated with auto loans. These fees can vary depending on the lender and the type of loan. Some common fees include:

- Origination Fee: A one-time fee charged by the lender to cover the cost of processing the loan application and setting up the loan account.

- Processing Fee: A fee charged by the lender to cover the cost of evaluating the borrower’s credit history and financial information.

- Prepayment Penalty: A fee charged by the lender if the borrower pays off the loan early. This fee is typically a percentage of the remaining loan balance.

Loan Terms and Length

The length of your auto loan, also known as the loan term, plays a significant role in determining your monthly payments and the total amount of interest you’ll pay over the life of the loan.

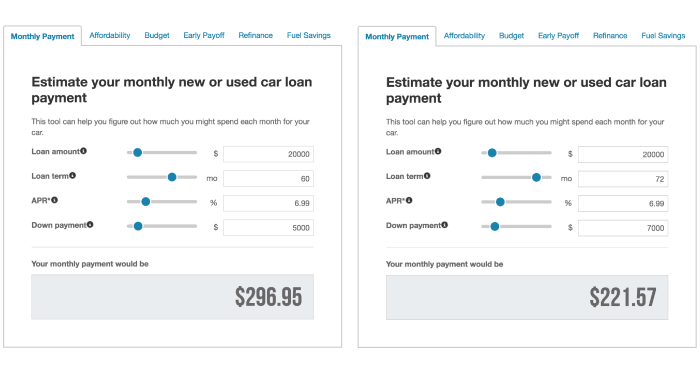

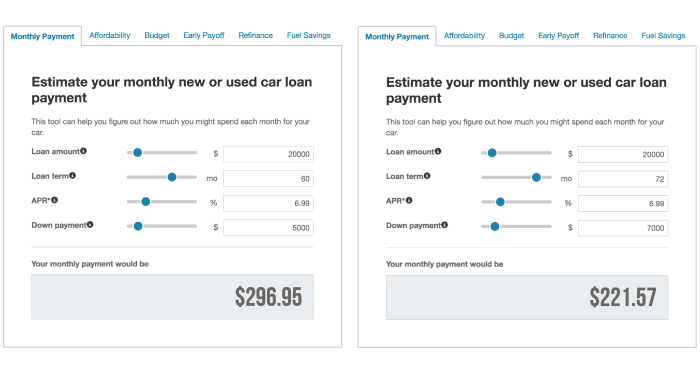

Generally, shorter loan terms result in higher monthly payments but lower total interest paid, while longer loan terms lead to lower monthly payments but higher total interest paid.

Typical Loan Terms

For high-value electric car loans, typical loan terms range from 36 to 84 months, with 60 and 72 months being common options. The availability and suitability of specific loan terms may vary depending on your credit score, the lender, and the specific electric car model.

Pros and Cons of Shorter vs. Longer Loan Terms

Shorter Loan Terms

- Pros: Higher monthly payments but lower total interest paid over the loan period.

- Cons: Can strain your monthly budget due to higher payments.

Longer Loan Terms

- Pros: Lower monthly payments, making them easier to manage within your budget.

- Cons: Higher total interest paid over the loan period.

Impact of Credit Score

A consumer’s credit score significantly influences the interest rate offered for an auto loan. Lenders consider a higher credit score as an indicator of a borrower’s reliability and lower risk, leading to more favorable loan terms.

Generally, a higher credit score corresponds to a lower interest rate, resulting in lower monthly payments and overall borrowing costs. Conversely, a lower credit score may result in a higher interest rate, increasing the total cost of the loan.

Credit Score Ranges and Corresponding Interest Rates

The relationship between credit score and interest rate can vary among lenders, but here’s an approximate range to provide an idea:

- Excellent Credit (750+): Interest rates typically range from 2.5% to 4.5%.

- Good Credit (670-749): Interest rates may fall between 4.5% and 6.5%.

- Fair Credit (580-669): Interest rates can range from 6.5% to 8.5%.

- Poor Credit (Below 580): Interest rates can be as high as 10% or more.

Strategies for Improving Credit Score

To secure a lower interest rate on an auto loan, consider implementing these strategies to improve your credit score:

- Pay Bills on Time: Consistently paying your bills on or before the due date demonstrates your reliability in managing debt.

- Keep Credit Utilization Low: Aim to keep your credit utilization ratio (the amount of credit you’re using compared to your total credit limit) below 30%.

- Reduce Debt: Work towards paying down existing debts to lower your overall debt-to-income ratio, making you a more attractive borrower.

- Obtain a Credit Mix: Having a mix of different types of credit, such as credit cards, installment loans, and mortgages, can positively impact your credit score.

- Monitor Your Credit Report: Regularly review your credit report for any errors or discrepancies that may be negatively affecting your score.

Incorporating Government Incentives and Rebates

Purchasing a high-value electric car can be more affordable with government incentives and rebates. These financial incentives aim to encourage the adoption of electric vehicles, reducing the cost of ownership and promoting sustainable transportation.

There are various types of government incentives available, including tax credits, purchase rebates, and state-level incentives. The eligibility requirements and application processes may vary depending on the specific incentive and the location.

Eligibility Requirements

To be eligible for government incentives, individuals or businesses must meet certain requirements, such as:

- Purchasing a new or used electric vehicle that meets specific criteria, such as minimum range or battery capacity.

- Meeting income or residency requirements.

- Filing taxes in the applicable jurisdiction.

Application Process

The application process for government incentives typically involves:

- Researching available incentives and determining eligibility.

- Gathering necessary documents, such as vehicle purchase documentation, tax forms, and proof of residency.

- Submitting an application to the appropriate government agency or authorized entity.

- Waiting for approval and receiving the incentive in the form of a tax credit, rebate, or other financial benefit.

Benefits of Government Incentives

Government incentives can provide significant financial benefits to individuals and businesses purchasing high-value electric cars. These benefits may include:

- Reducing the overall cost of the vehicle, making it more affordable.

- Encouraging the adoption of electric vehicles, promoting environmental sustainability.

- Stimulating the economy by supporting the electric vehicle industry and related businesses.

Trade-In Value and Negative Equity

The trade-in value of a current vehicle can significantly impact the down payment and monthly payments for a new high-value electric car. A higher trade-in value reduces the amount of money needed for the down payment, resulting in lower monthly payments.

Conversely, a lower trade-in value increases the down payment and monthly payments.

Negative Equity

Negative equity occurs when the amount owed on a current vehicle exceeds its market value. This can happen due to depreciation, a decrease in the vehicle’s value over time, or taking out a loan for more than the vehicle’s worth.

Negative equity can make it challenging to purchase a new high-value electric car, as it increases the amount of money needed for the down payment.

Strategies for Minimizing the Impact of Negative Equity

There are several strategies to minimize the impact of negative equity when purchasing a new high-value electric car:

- Increase the Down Payment: By increasing the down payment, the amount of negative equity that needs to be financed is reduced, resulting in lower monthly payments.

- Refinance the Current Vehicle: Refinancing the current vehicle with a lower interest rate can reduce the monthly payments, making it easier to pay off the negative equity more quickly.

- Sell the Current Vehicle Privately: Selling the current vehicle privately may yield a higher price than trading it in, reducing the amount of negative equity.

- Wait Until the Negative Equity is Paid Off: If possible, waiting until the negative equity is paid off before purchasing a new high-value electric car can eliminate the need to roll the negative equity into the new loan.

By carefully considering the trade-in value of a current vehicle and implementing strategies to minimize the impact of negative equity, buyers can make the purchase of a new high-value electric car more affordable.

Additional Considerations

Affordability of a high-value electric car extends beyond the initial purchase price and loan payments. Other factors that impact the overall cost of ownership include insurance, maintenance, charging infrastructure, and long-term savings.

Insurance Costs

Electric cars typically have higher insurance premiums compared to gasoline-powered vehicles due to their higher replacement costs. Factors such as the make, model, age, and safety features of the car, as well as the driver’s age, location, and driving history, influence the insurance rate.

Maintenance Expenses

Electric cars generally require less maintenance than gasoline-powered vehicles. They have fewer moving parts, no oil changes, and regenerative braking systems that reduce wear on brake pads. However, the cost of replacing an electric car’s battery can be substantial, and it’s essential to factor this into the long-term ownership budget.

Charging Infrastructure Availability

The availability of charging infrastructure is a crucial consideration for electric car owners. The number of public charging stations, their proximity to the owner’s home and workplace, and the charging speeds they offer can impact the convenience and practicality of owning an electric car.

Long-Term Savings

Electric cars offer potential long-term savings in fuel costs and tax incentives. Electricity is generally cheaper than gasoline, and many countries and states provide tax credits and rebates for electric car purchases. These incentives can significantly reduce the overall cost of ownership over time.

Last Point

As you embark on the path towards electric car ownership, remember that meticulous planning and informed decisions are key. Employing an auto loan calculator can empower you to navigate the financial intricacies involved, enabling you to make a purchase that aligns with your budget and long-term goals.

Embrace the journey towards sustainable mobility, and may your electric car ownership experience be both fulfilling and financially prudent.

FAQs

Can I use an auto loan calculator before visiting a dealership?

Absolutely! Using an auto loan calculator beforehand allows you to explore various loan scenarios and gain a clear understanding of your potential monthly payments and total borrowing costs. This empowers you to enter dealership negotiations with a well-informed perspective.

How do I determine the ideal loan term for my electric car purchase?

The ideal loan term depends on your financial situation and preferences. Shorter loan terms typically result in higher monthly payments but lower total interest paid, while longer loan terms offer lower monthly payments but higher total interest. Consider your budget and long-term financial goals when making this decision.

What strategies can I employ to improve my credit score before applying for an auto loan?

To improve your credit score, consider paying bills on time, reducing your credit utilization, and disputing any errors on your credit report. Additionally, building a positive credit history by using credit responsibly over an extended period can also contribute to a higher credit score.